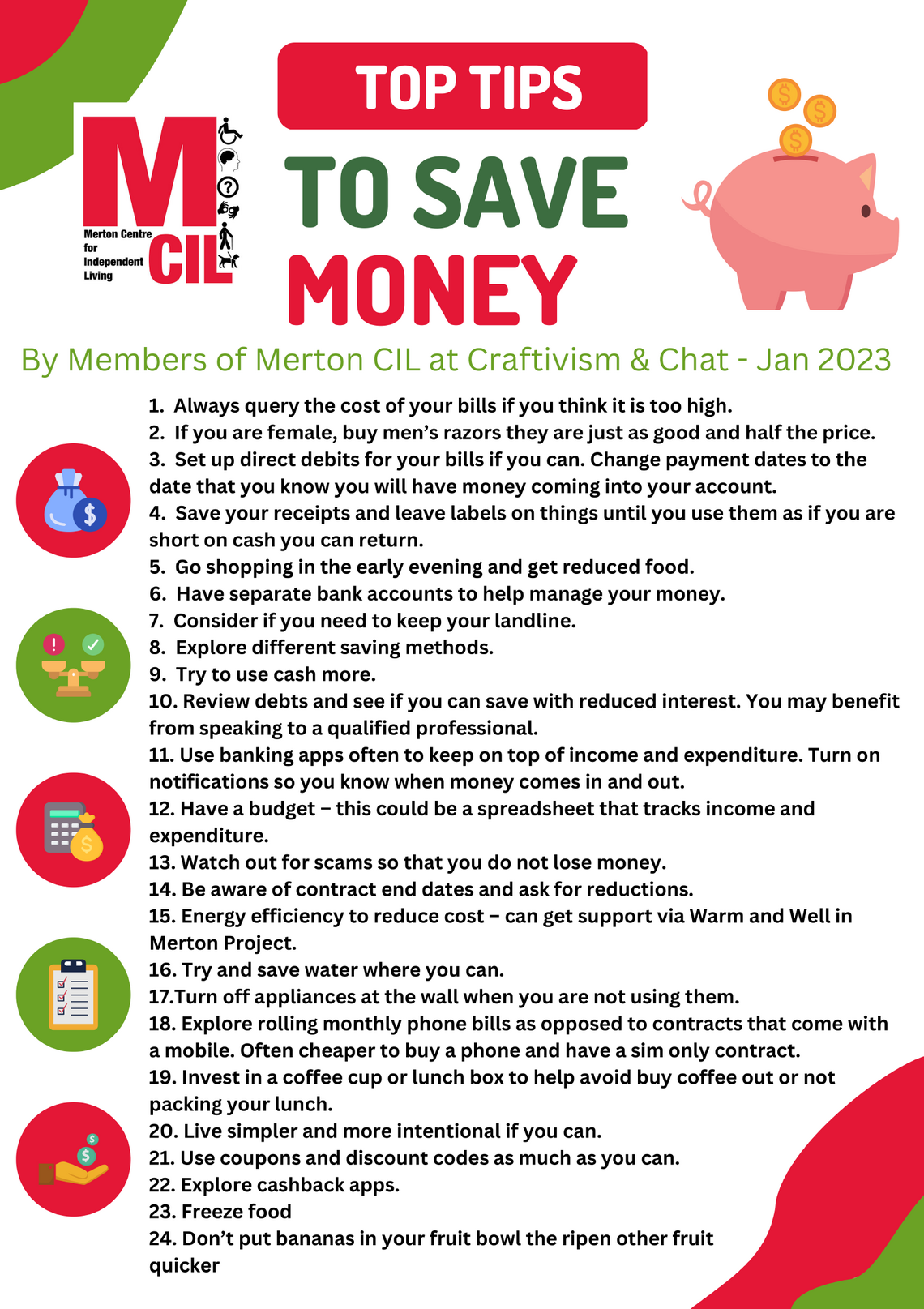

Our top tips for saving money, if possible.

These tips were shared by attendees the session and are not financial advice.

You can download a PDF of the minutes from the session here - Craftivism Jan 2023 Minutes

Our current money worries

Below are some of the top worries that attendees at the session had around money.

- Being able to afford the extra costs of disability

- Unexpected medical costs such as dentist

- Managing benefits with increased costs

- Managing utilities bills, especially when the government support ends

- The inability to save

- That something goes wrong with my home. For example, the boiler

- Disrepair

- The rising cost of food

- Insurance costs are increasing – high cost and little return

- That we are not financially resilient

- No disposable income for holidays

- Costs of running a car – petrol, ULEZ etc

- Vet bills

- Charging when you are self employed

- Understanding the changing interest rates and what this means for personal finance

- Not being able to support family financially anymore

- Income is not increasing but everything else is

There will be a follow up session that explores how to create a budget and more in April 2023. Please RSVP via email.